Investing in junk silver coins can be a rewarding venture for both novice and seasoned investors. These coins offer a tangible way to invest in silver without breaking the bank. The allure of holding physical silver, coupled with its historical value as a form of currency, makes junk silver coins an appealing investment option. But what exactly are junk silver coins, and how do you get started with investing in them? Let’s dive into the world of junk silver coins and uncover how you can make a smart investment.

What Are Junk Silver Coins?

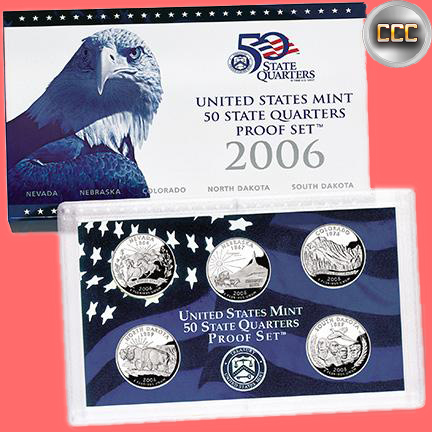

Junk silver coins are old U.S. currency coins that have no collectible or numismatic value beyond the silver content they contain. Typically, these coins were minted before 1965 and consist of 90% silver. The term “junk” simply refers to their lack of collector value, not the condition of the coins. Despite their humble name, these coins are far from worthless; they represent a practical and historical investment medium.

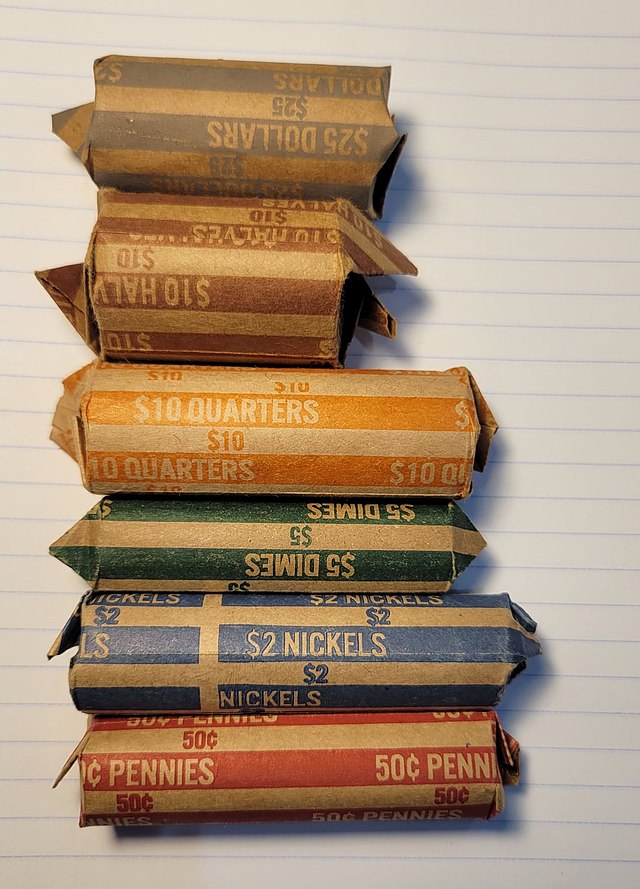

Common types of junk silver coins include Mercury dimes, Roosevelt Dimes, Washington Quarters, and Kennedy Half Dollars. These coins are often sold in bags or rolls and are valued for their silver content, often referred to as their silver melt value. The historical significance and the intrinsic value of the silver make these coins a reliable store of wealth. Their availability in various denominations also provides flexibility in terms of investment size and storage.

Why Invest in Junk Silver Coins?

Affordability and Accessibility

Junk silver coins are one of the most affordable ways to invest in silver or start a coin collection. They are widely available and can be purchased in various quantities, making them accessible for investors or collectors alike with varying budget sizes. Whether you want a single roll of dimes or a large bag of half-dollar coins, there’s an option for every investor. This accessibility allows even those with limited funds to start building a precious metals portfolio.

Moreover, the transaction costs associated with junk silver coins tend to be lower compared to other forms of silver investments, such as bullion or collectible coins. This makes them an ideal choice for investors looking to minimize their entry barriers into the silver market. The affordability also means that investors can gradually increase their holdings over time without needing to make a large initial outlay.

Hedge Against Inflation

Investing in silver, including junk silver coins, can be an effective hedge against inflation. As the value of paper currency fluctuates, precious metals like silver tend to retain their value over time. This makes junk silver coins a stable investment option during uncertain economic times. By holding a tangible asset, investors can protect their wealth from the eroding effects of inflation.

Historically, silver has maintained its purchasing power even when fiat currencies have faltered. This makes it a strategic asset to hold during periods of economic instability or when inflation rates rise. Junk silver coins, with their high silver content, can offer a reliable safeguard against the devaluation of paper money, ensuring that investors maintain their buying power in the long run.

Easy to Liquidate

Junk silver coins are relatively easy to sell or trade. Since they are recognized and accepted widely, you can liquidate your investment quickly if needed. This liquidity adds an extra layer of security to your investment portfolio. Whether selling to a dealer, collector, or through a private sale, junk silver coins provide flexibility in accessing cash quickly.

The wide acceptance and recognition of these coins mean they can be easily converted back into cash, especially during times of economic distress when liquidity is crucial. This ease of liquidation makes junk silver coins a practical choice for those who might need to access their investments on short notice, providing peace of mind that their assets are not locked away.

How to Start Investing in Junk Silver Coins

Determine Your Investment Goals

Before you start buying junk silver coins, it’s important to define your investment goals. Are you looking to diversify your portfolio, hedge against inflation, or simply start a collection? Knowing your objectives will guide your purchasing decisions and help you choose the best options for your needs. Clear goals will also help you determine the appropriate amount of your portfolio to allocate to silver.

Understanding your timeline is another crucial aspect of setting your investment goals. Are you investing for the short term, hoping to capitalize on market fluctuations, or are you in it for the long haul, aiming to preserve wealth? By identifying your goals, you can tailor your investment strategy to suit your specific needs and circumstances.

Know the Silver Melt Value

The silver melt value is the intrinsic value of the silver content in the coins. This is an essential factor to consider when investing in junk silver. You can calculate the melt value by multiplying the coin’s weight by the current spot price of silver. Many online calculators and resources can help you determine this value easily. Understanding the melt value ensures you are making informed purchasing decisions based on the real worth of the silver content.

Keeping track of the silver spot price is crucial, as it fluctuates with market conditions. Regularly checking the melt value of your coins can help you decide when to buy or sell, maximizing your investment returns. Being aware of these values will also help you avoid overpaying when purchasing coins and ensure you receive a fair price when selling.

Choose the Right Coins

When investing in junk silver coins, you’ll come across various types, including:

Junk Silver Mercury Dimes:

- Minted from 1916 to 1945, these dimes are popular among collectors and investors. Their intricate design and historical significance make them a favorite choice.

Junk Silver Roosevelt Dimes:

- Minted from 1946 to 1964, these are more abundant and often available at lower premiums. They are a practical option for those focused on silver content rather than numismatic value.

Junk Silver Washington Quarters:

- Minted from 1932 to 1964, they offer good value and are easy to find. Their larger size compared to dimes makes them an efficient way to accumulate silver.

Junk Silver Half Dollars:

- Minted from 1948 to 1963, these coins contain more silver per coin, making them a great option for serious investors. Their higher silver content per coin can simplify storage and handling.

Each type of coin offers different advantages, and your choice may depend on availability, price, and personal preference. Consider diversifying your holdings across different types to balance your investment.

Find the Best Price

To get the best price on junk silver coins, it’s wise to shop around. Check various dealers, both online and in person, and compare prices. Look for dealers with a good reputation and transparent pricing. Buying in bulk, such as junk silver bags, often results in better pricing per ounce. Bulk purchases can lead to significant savings, especially for long-term investors. Our Coin Store has quite a few affordable bulk 90% silver listings you may want to check out.

Don’t forget to factor in any additional costs such as shipping, insurance, or transaction fees when comparing prices. These can add up and affect the overall cost-effectiveness of your investment. Keep in mind all constitutional silver lots we sell come with free shipping! Negotiating with dealers or timing your purchase to coincide with market dips can also help you secure a better deal.

Tips for Buying Junk Silver Coins

Verify Authenticity

Always verify the authenticity of the coins before making a purchase. Reputable dealers should provide guarantees or certifications that confirm the silver content and authenticity of the coins. Our coin store has a 7-day money-back guarantee, and any other shop worth their salt should have the same. This step is crucial in protecting yourself against counterfeit coins that can occasionally surface in the market.

If you are purchasing from private sellers or smaller dealers, consider using a silver testing kit or consulting with a professional appraiser to ensure the coins are genuine. You’d be surprised at the amount of counterfeits people attempt to pass. Ensuring authenticity not only protects your investment but also maintains the integrity of the silver market as a whole.

Store Your Coins Safely

Proper storage is crucial to maintain the condition and value of your junk silver coins. Store them in a dry, cool place away from humidity and direct sunlight. Using airtight containers or coin holders can also help preserve their condition. Protecting your coins from environmental factors ensures they remain in the best possible state, which is important if you ever decide to sell. We stand behind all of the coin supplies you may find in our store.

Organizing and cataloging your collection can also aid in keeping track of your investment, making it easier to manage and appraise. Consider investing in a safe or using a bank’s safety deposit box for large collections to enhance security and peace of mind.

Stay Informed About Market Trends

Keep an eye on the silver market and economic trends. Knowing when to buy or sell can maximize your investment returns. Subscribe to newsletters, follow financial news, and join online forums to stay informed. Being proactive in tracking market conditions allows you to make timely decisions, optimizing your investment strategy.

Engaging with communities of like-minded investors, like the coin community or the Wallstreet Silver subreddit can provide valuable insights and tips, enhancing your understanding of the market. Regularly updating your knowledge ensures you are always equipped to make informed decisions about your investments.

Potential Risks and Considerations

While investing in junk silver coins is generally safe, there are a few risks to be aware of:

Market Fluctuations

The value of silver can fluctuate due to various factors, including market demand, economic conditions, and geopolitical events. Be prepared for possible changes in the value of your investment. Understanding these market dynamics can help you anticipate and respond to fluctuations in silver prices.

Diversifying your investment portfolio can mitigate the risks associated with market fluctuations. By not putting all your eggs in one basket, you can protect your overall financial health from the volatility of a single asset class.

Dealer Scams

Unfortunately, not all dealers are trustworthy. Beware of scams and counterfeit coins. Always research and choose reputable dealers with positive reviews and transparent practices. Building a relationship with a trusted dealer can provide assurance and ease of transactions in the future.

Participating in reputable coin shows or auctions can also be a safer avenue to acquire junk silver coins. These venues often have strict vetting processes to ensure authenticity and legitimacy, reducing the risk of scams.

Storage and Security

Storing large quantities of silver at home can pose security risks. Consider using a safe deposit box or secure home safe to protect your investment from theft or damage. Ensuring your storage solutions are robust can prevent potential losses and give you peace of mind.

Additionally, consider insuring your silver collection to safeguard against unforeseen circumstances. Insurance can offer a financial safety net, compensating for losses due to theft or natural disasters.

Thanks For Reading!

Investing in junk silver coins can be a rewarding and stable addition to your investment portfolio. By understanding the market, knowing how to find the best prices, and taking steps to secure your investment, you can enjoy the benefits of investing in silver. Whether you’re a new investor, collector, or just looking to diversify your assets, junk silver coins offer an accessible and potentially profitable opportunity. With careful planning and due diligence, you can turn these historical pieces into a valuable component of your financial strategy.

Michael D. Larsen

IT Administrator, Butterfly Rancher, Co-Owner of Coined Insights and Larsen & Co.

I’m a lifelong coin collector and former professional dealer with a deep passion for numismatics. I have a lifetime of hands-on experience handling rare and historic coins, I created Coined Insights to offer a trustworthy digital coin store, and so I can share my expert knowledge, market trends, and coin-collecting tips. Whether you’re a beginner or an experienced collector, my goal is to make coin collecting more accessible and rewarding. I am also a co-owner of Larsen & Co., a web development company currently operating 3 websites all on topics I am very passionate about. Feel free to learn more on our About page!